USD/MXN could hit 13.30

Genevieve Signoret & Patrick Signoret

15 August 2014

Currencies

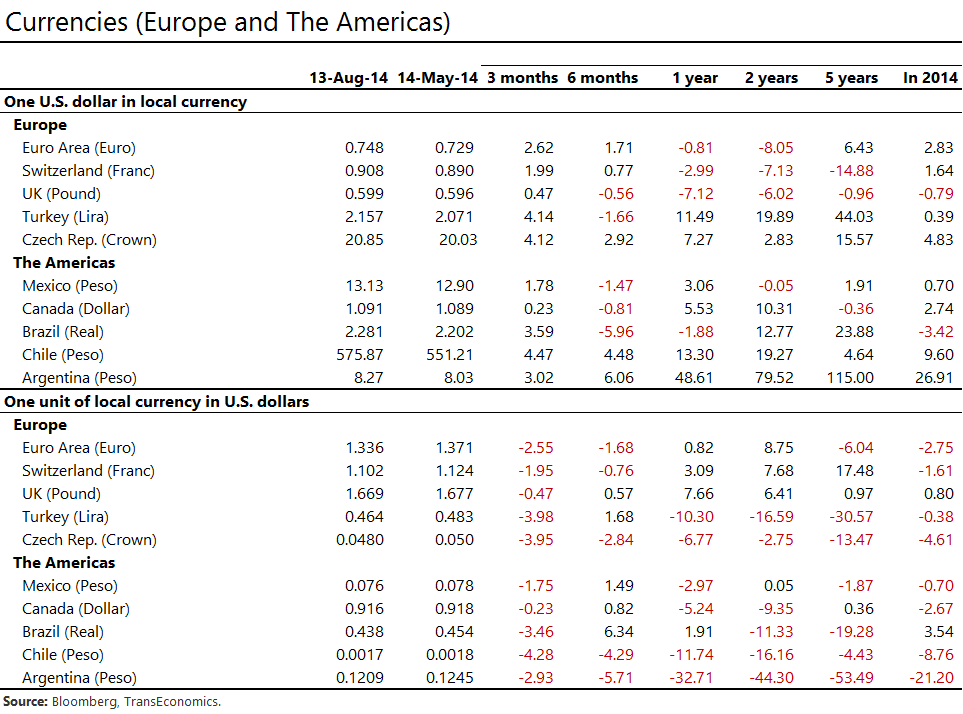

- The recent volatility event may or may not be over. Should it continue and worsen, the peso could fall to $1.00=MXN 13.30.

- The euro is trending down against the dollar probably because of outlooks for monetary policy in both regions. Additionally, the recent risk off event may be weakening the euro further. These forex movements are exacerbating U.S. dollar expressions of European equity valuation drops.

- Normally in a bout of risk aversion, yen carry trade is reversed and the yen pops up against the dollar. On this occasion, however, the yen has actually weakened further. Perhaps the forces driving its downward trend are overpowering (offsetting) traditional flight-to-quality behavior.

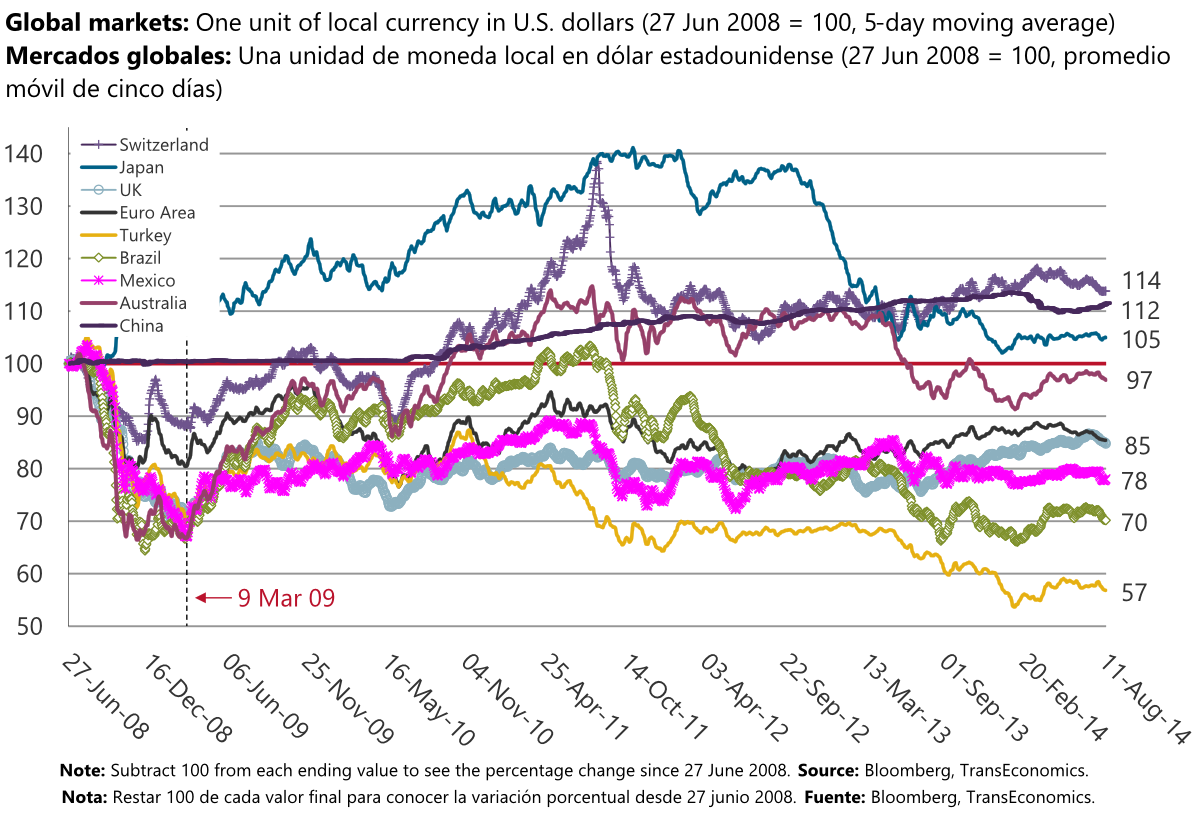

Recent risk aversion has hurt currency valuations against the dollar for all countries shown here except China (the yuan) and Japan (the yen)

The recent volatility event may or may not be over. Should it continue and worsen, the peso could fall to $1.00=MXN 13.30.

The euro is trending down against the dollar probably because of outlooks for monetary policy in both regions. Additionally, the recent risk off event may be weakening the euro further.

Normally in a bout of risk aversion, yen carry trade is reversed and the yen pops up against the dollar. Perhaps the forces behind its downward trend are simply overpowering this flight-to-quality behavior.

Comentarios: Deje su comentario.