European equity dip is an opportunity

Genevieve Signoret

Equity

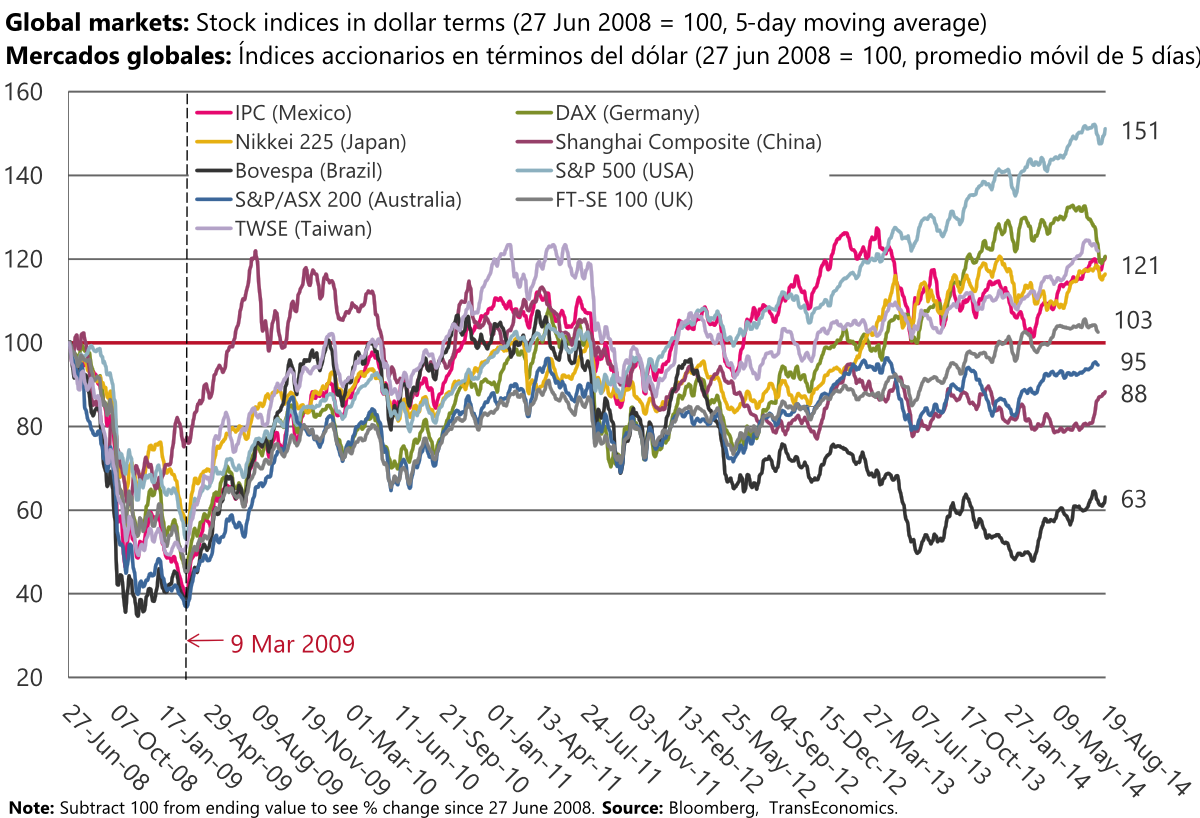

Most European stock markets are down in euro and, especially, dollar terms from three months ago. Because we hold to our positive view on European equity, we see this dip as a buying opportunity.

China’s and Brazil’s stock markets have attractive valuations and upward momentum both. Our clients with long-term investment horizons have exposure to them through a broad emerging market equity ETF.

The July–August bout of what Genevieve characterized as “benign volatility” has ended.

Grupo Lala SAB, Mexico’s largest milk producer, and Grupo Carso SAB, a multi-industry holding company owned by Carlos Slim, will gain entry on September 1 to Mexico’s stock exchange index IPC. They will displace two Mexican retailers: Chedraui and Grupo Sanborns. Note that Grupo Carso has an 82% share in Grupo Sanborns. (CNN Expansión).

China’s and Brazil’s stock markets have attractive valuations and upward momentum both

Most European stock markets are down in euro and, especially, dollar terms from three months ago—we see this as a buying opportunity