Long position in 7–10-year USTs has been a winner

Genevieve Signoret

Fixed Income

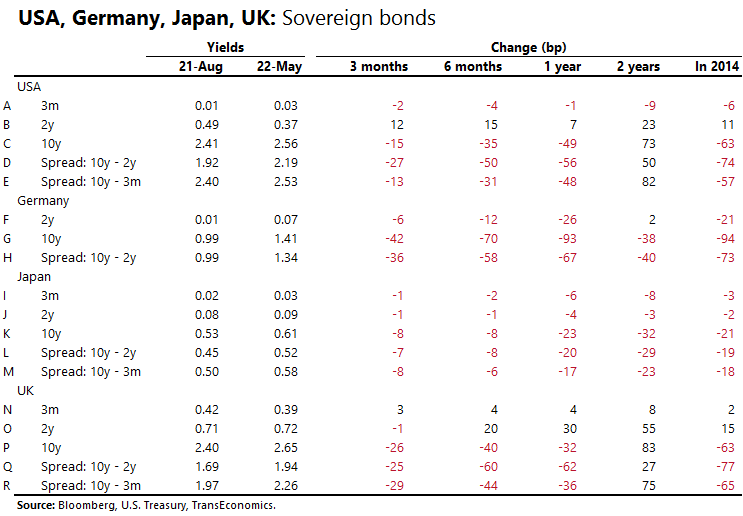

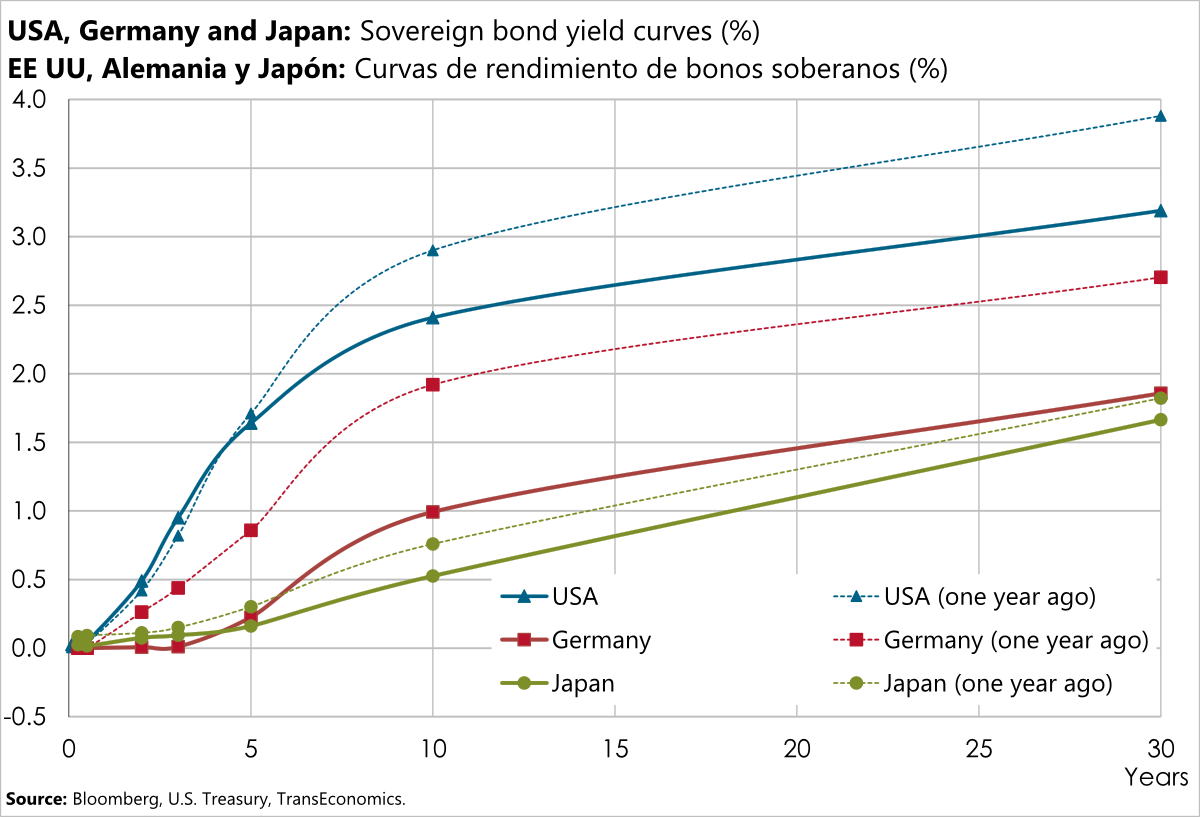

We thought that the U.S. Treasury yield curve would steepen this year. It has done so on the short end but on the long end it has flattened. So the positions we took for clients in 7-10 Treasuries, designed to be a hedge to moderate portfolio losses during risk-off moments, has instead been a winner.

This same phenomenon shows up in the UK gilt curve, by the way.

We close by sharing some good reads from the past week for global fixed income investors:

- The U.S. Corporate Speculative-Grade Default Rate Is Expected To Rise To 2.7% By June 2015 (S&P)

- Don’t fight the US Treasury bond rally (FT$)

- China Credit Spotlight: How Fiscal Reforms Could Reshape LRG Borrowing (S&P)

We thought the U.S. Treasury yield curve would steepen this year. It has done so on the short end but on the long end it has flattened.

Because the long end of the U.S. yield curve has flattened, our clients’ positions in 7-10 Treasuries, designed to be a hedge, has been a winner

Notice how same thing is happening to the UK gilt curve, even though the BoE is expected to hike rates several months earlier than the Fed