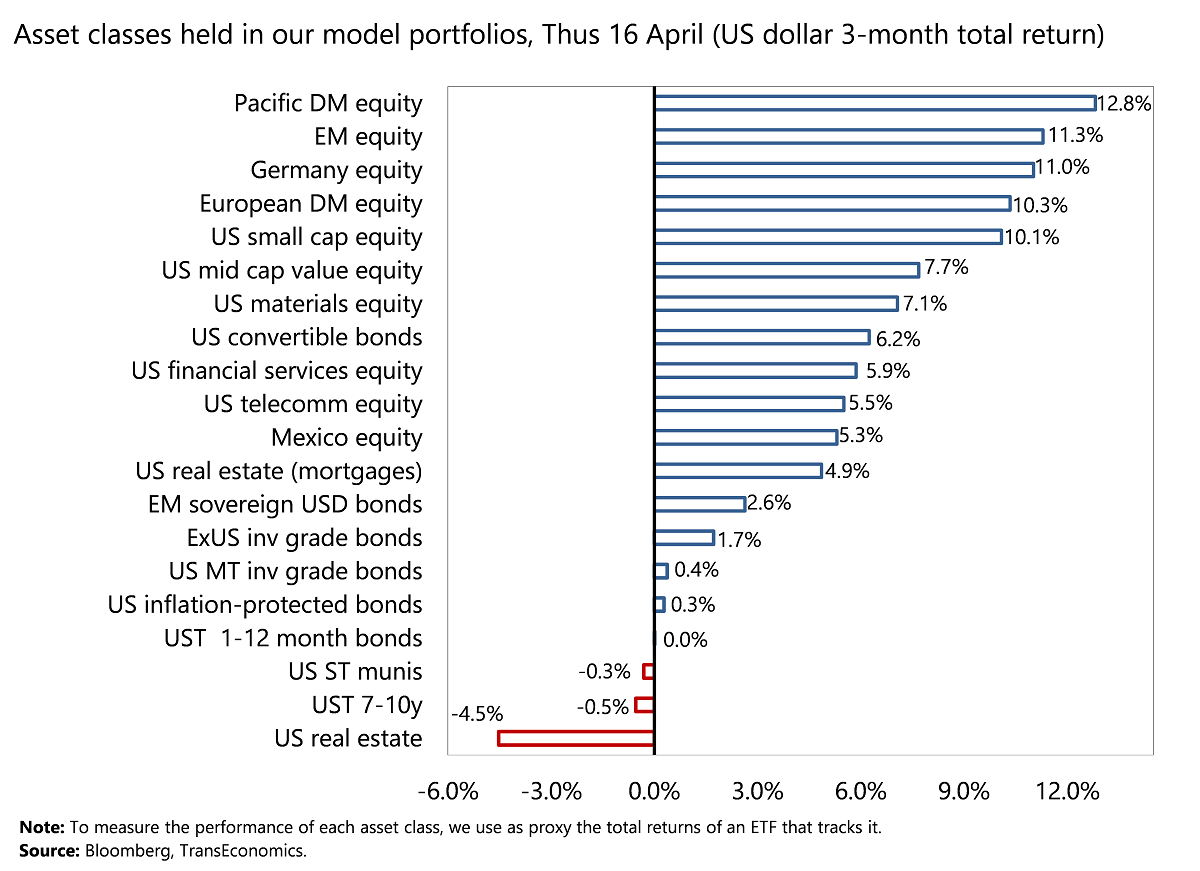

Pacific DM equity: 12.8% in USD terms in 3m

Genevieve Signoret

Our Performance

(Data corrected 21 May 2015)

In the past three months, the asset classes in our model portfolios[1] that delivered the highest U.S. dollar returns were Pacific developed market equity (12.8%), Emerging market equity (11.3%) and Germany equity (11.0%),

Producing the lowest returns (in dollar terms) were US real estate (–4.5%), 7-10y USTs (–0.5%) and US short-term munis (–0.3%), and

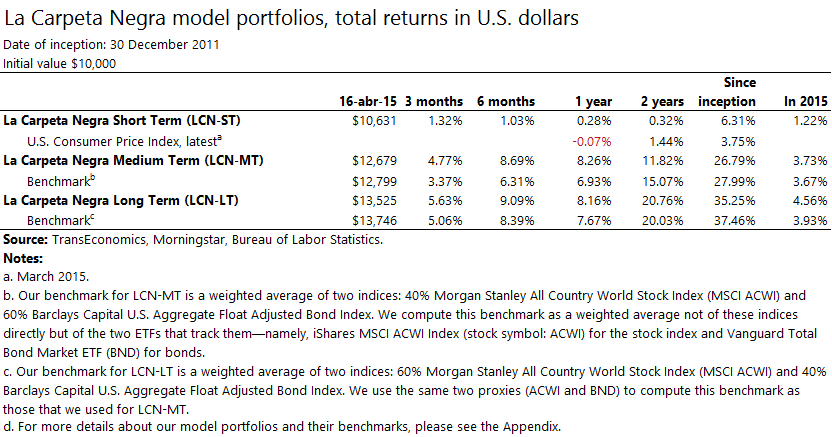

Over the past 12 months, all three of our model portfolios have outperformed their benchmarks:

- LCN-ST +0.3% (benchmark: 0.0%)

- LCN-MT +8.3% (benchmark: +6.9%)

- LCN-LT +8.2% (benchmark: +7.7%)

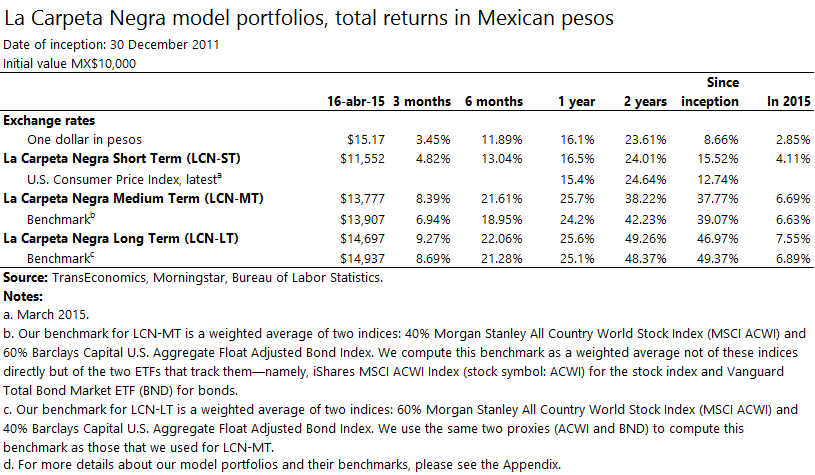

In peso terms, our 12-month performance was as follows:

- LCN-ST +16.5% (benchmark +16.1%)

- LCN-MT +25.7% (benchmark +24.2%)

- LCN-LT +25.6% (benchmark +25.1%)

[1] Read descriptions of these portfolios here. Clients receive details on their composition in addition to individualized strategies and portfolio management services. To request more information, please write to patrimonial@transeconomics.com.