Will drop in market-implied inflation expectations delay FOMC?

Genevieve Signoret

Fixed Income

U.S. 5-year Treasury bonds are now paying just a 152bp premium over TIPS. In our view, a sustained trend drop underneath 150bp will delay the first FOMC rate cut to beyond September if core PCE inflation and real wage trends start deteriorating too.

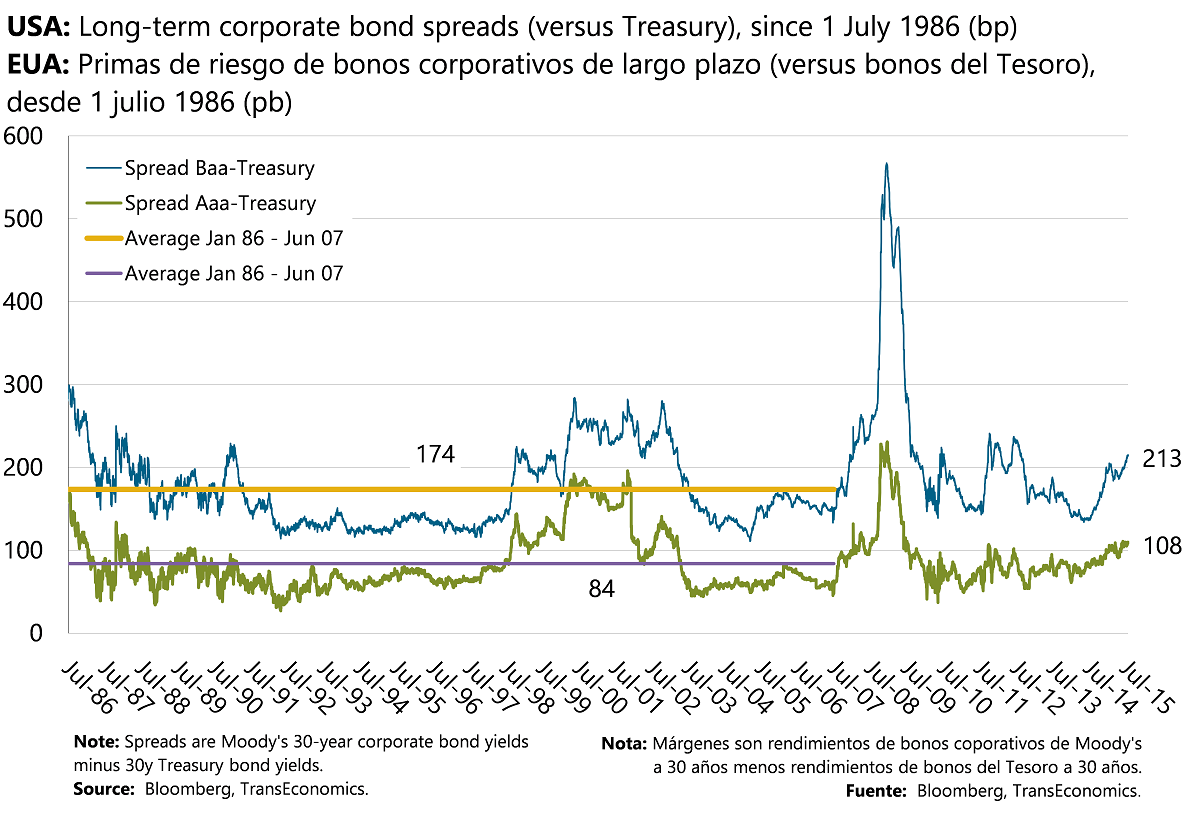

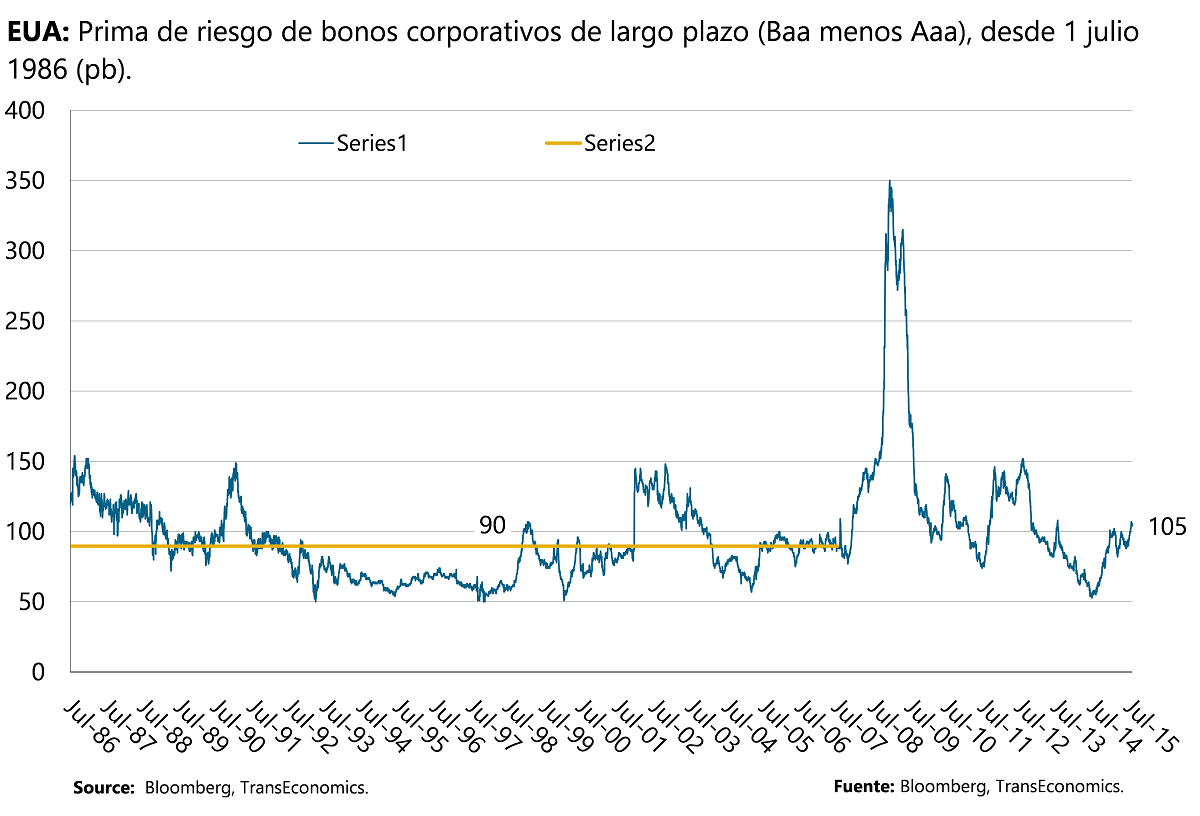

U.S. corporate junk bond spreads over investment grade corporate bonds and the spreads of all corporate bonds over comparable Treasuries have risen to levels considerably higher than their historic (pre-crisis) averages. We take heart in this. We think that this correction will help these two asset classes to not overreact when the Fed announces its first rate hike.

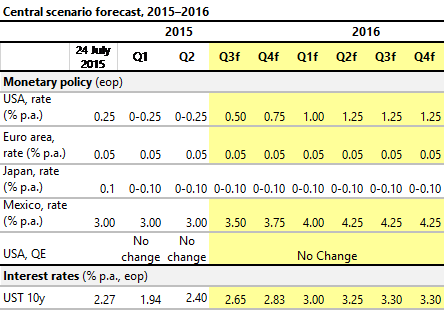

We hold to our central-scenario forecast for monetary policy and rates.

US 5y T bond spreads over comparable TIPS are again falling. We think that, only if core PCE inflation and real wages start deteriorating too, will the FOMC delay.

U.S. long term junk bonds now pay a 15bp premium over the yield on investment grade corporate bonds

Corporate bond spreads over comparable Treasuries are now considerably wider than their pre-crisis average spans