What are we doing about bond market risk?

Genevieve Signoret

Fixed Income

Experts see bond market risk

In its October 2015 edition of Global Financial Stability Report (GFSR), the IMF reports financial conditions in emerging economies to have worsened since April. Their concern is largest for emerging markets, where private sector bank borrowing, foreign-currency exposure, and corporate bond issuance are on the rise. Risks loom largest in commodity exporting countries, where, often, corporate and sovereign debt risk are hard to tell apart: state-owned enterprises (SOEs) may supply fiscal revenue and have contingent liabilities that, in a scenario in which commodity prices keep on plunging, could require state takeover.

We hold no EM corporate bonds in client portfolios and only temporarily hold EM sovereign debt, all of it USD-denominated

Our clients have no exposure to emerging market corporate bonds but do have small tactical positions in dollar-denominated emerging market sovereign debt. We intend to close these positions out as soon as we feel secure that the Fed is close to hiking rates to protect client wealth from copycat moves by emerging market central banks geared at protecting home-country currency valuations. We expect that this move on our part to close out tactical longs in emerging market sovereign debt will take place long before any risk from a state takeover of contingent liabilities is likely to blow up.

Experts worry about DM fixed income also, in particular about liquidity

In developed markets, the focus is on liquidity risks. These, say analysts, the IMF, and the New York Fed, have been rising on account of market structure changes—increased concentrations in corporate bonds by mutual funds, pension funds, and insurance companies, and balance sheets swollen with sovereign bond holdings by central banks practicing quantitative easing.

Have you ever dislocated your shoulder?

The concern is that a market dislocation could take place that causes prices to momentarily dive and that holders even of developed market bonds wishing to offload their bonds might momentarily find no takers.

Treasuries would not be immune

These risks are said to extend even to currently liquid market such as the one for U.S. Treasury securities. (To convince yourself that such a risk is present, think back to Germany’s “Bund tantrum” in April of last year.)

We’re selling corporate bonds and are unafraid of U.S. Treasuries

We have been gradually exiting from corporate bonds anyway, and are not afraid of U.S Treasuries.

Liquidity risks aren’t the only reason

We’re exiting corporate bonds because (a) we expect them to perform poorly until after the Fed starts to hike and markets finally become convinced, as we are today, that the pace at which the Fed will raise rates will be glacial; (b) the credit cycle begun in 2009 has matured, so U.S. corporate downgrades have sped up; (c) this asset class even in normal times has liquidity risks, and now experts think these risks have risen.

First we shed our corporate junk

We began our exit by closing out client positions in U.S. junk bonds quite some time ago, holding on only to small positions in U.S. convertible bonds and investment grade bonds. Then, last week, we began replacing U.S. investment grade corporates (average duration: 5–10 years) with higher-quality U.S. Treasuries (average duration: 7–10 years).

Investment grade bonds have disappointed us— especially during the correction

Admittedly, our decision of last week to start switching from corporate investment grade to Treasuries was driven chiefly by disappointing investment grade corporate bond returns relative to those on comparable Treasury bonds, especially during the ongoing market correction. But it has the added benefit of offering protection from the liquidity risks nagging the IMF and others.

We trust U.S. Treasuries

Of course, our U.S. Treasury holdings would not protect clients from a momentary disruption in the Treasury market. We think, however, that, either the episode would be over in a matter of minutes, in which case our client portfolios, which have investment horizons of at least six months, would be unaffected, or, if the episode threatened to become prolonged, the Fed would intervene by supplying bonds via issuance of repos (repurchase agreements).

In summary, our portfolio strategies do take into account the bond market liquidity risks being examined by the IMF and others

In summary, we’ve taken note of the global bond market risks being spoken of by bond market analysts at central banks, multilaterals, and private banks. Our clients’ exposure to emerging market corporate bonds is nil, to emerging market sovereign bonds is tiny and temporary, to developed market junk bonds is nil, and to developed market corporate bonds is small and, as of last week, shrinking. Their exposure to U.S. Treasury securities is much larger. But although we can’t rule out a liquidity disruption in that market, we think that, should one occur, it wouldn’t last long.

Latest monetary policy and bond yield forecasts

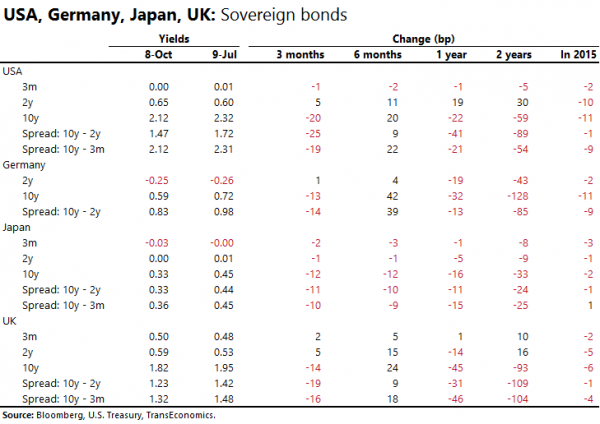

Concerns about liquidity and maturation of the credit cycle are causing corporate credit to spike. We are taking refuge in Treasury bonds.

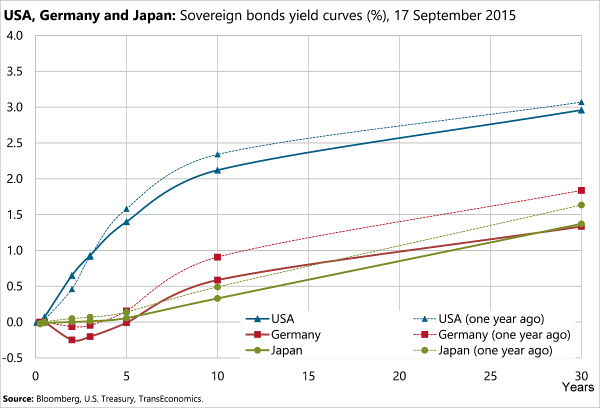

Notice the negative yields in Germany and how all three yield curves

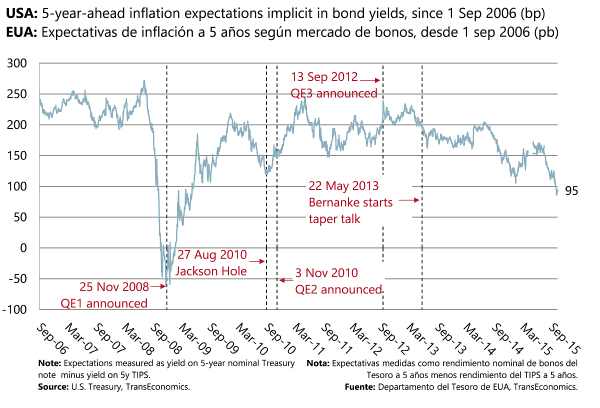

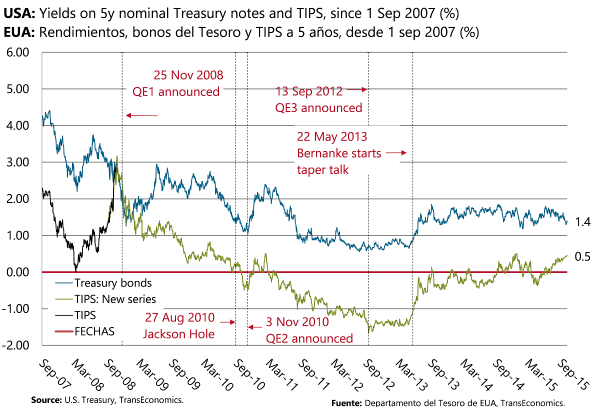

Bond-market–implied inflation expectations are taking a dive, confirming our forecast that the Fed won’t raise rates before March.