Flat US yield curve: bad omen or sign of Fed credibility?

Genevieve Signoret

Fixed Income

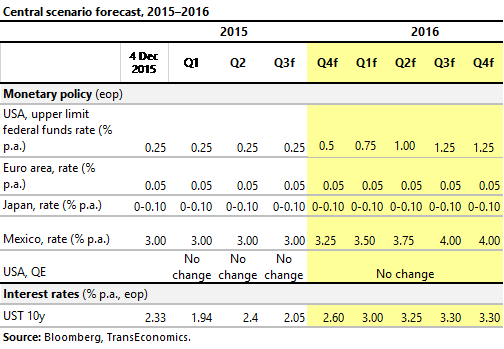

We expect bond markets to do the irrational thing and react adversely to the Fed’s first hike: we project the yield on 10y bond to hop up from today’s 2.33% to 2.60%.

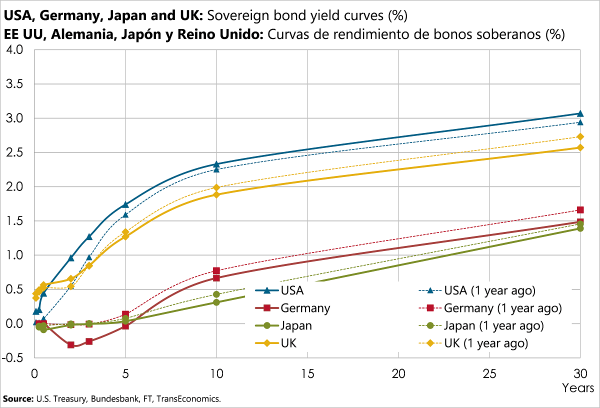

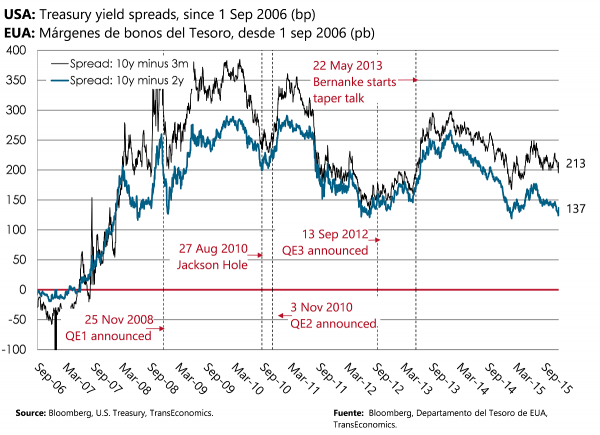

We have no satisfactory explanation as to why the US yield curve has steepened so little in the past year. We find the current flatness of the US yield curve to be perplexing—we expected it to steepen faster and think that it will do so soon. If not, a recession may be brewing, and the Fed is about to make a huge gaffe.

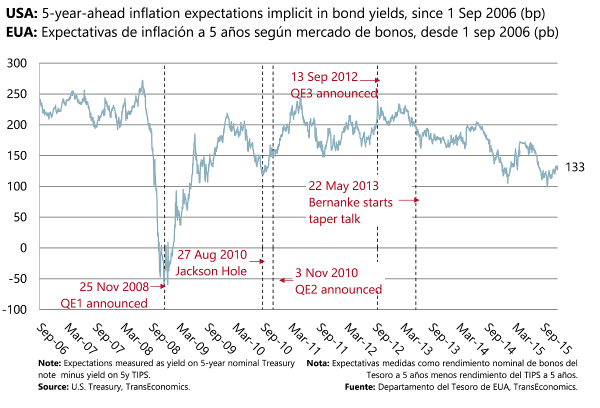

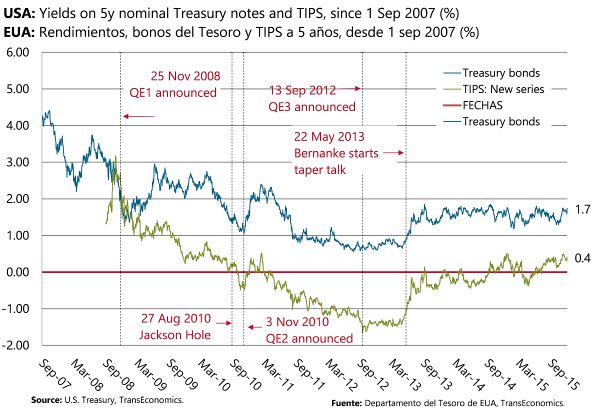

5-year breakeven rates (the spread between nominal and comparable inflation-adjusted Treasury debt securities) also raise a red flag: they closed at 1.33% today. On the positive side, breakeven rates have recovered from a recent 1%.

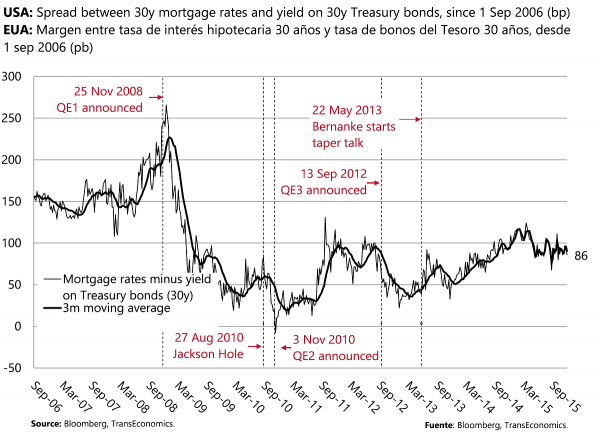

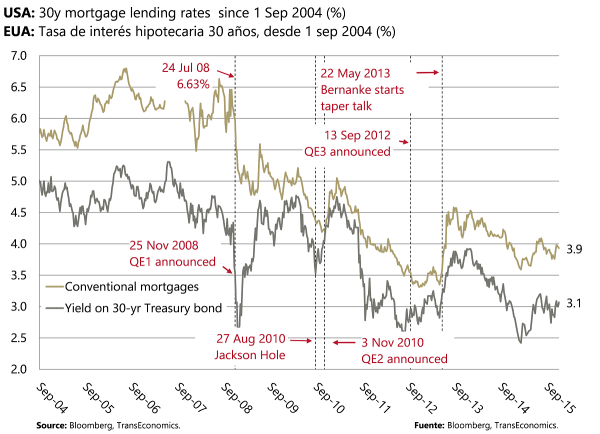

Also positive is that mortgage rates in absolute terms and measured as spreads over comparable Treasuries have recovered and now are fluctuating flat. These recent trends are positive given the strong consensus that the Fed will hike rates in just 12 days—on December 16.

Our central scenario puts more weight on the positive signals that are breakeven recovery and mortgage rate stability so close to the “day of doom” than on the surprising yield curve flatness and low absolute breakeven rate levels. In this scenario, we interpret the negative signs as simply signs that the Fed has achieved credibility: a large chunk of the market now believes the Fed when it promises to tighten ever so slowly.

As for December 16, not everyone is convinced that the Fed is going to start its normalization process this soon. The unconvinced will react adversely to the first hike. Hence we see the yield on the 10-year U.S. Treasury bond hopping up to 2.60% from today’s closing yield of 2.33%

We expect markets to do the irrational thing and react adversely to the Fed’s first hike: yield on 10y bond hops up to 2.60%

We find the current flatness of the US yield curve to be perplexing—we expected it to steepen faster and think that it will do so soon. If not, it could signal that a recession is brewing.

Another negative signal for breakeven 5y-out inflation rate (a measure of inflation expectations) is only 1.33%.

This graph shows the separate components that form the previous graph (1.7%-0.4%=1.3%)

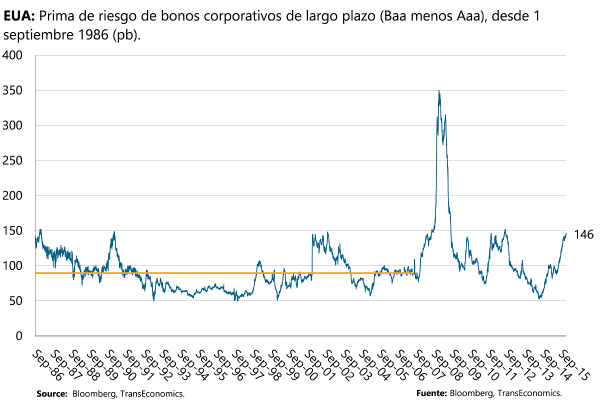

Junk bond spreads are spiking.

It’s true but hard to grasp that the Fed is actually going to hike rates with yield curves this flat. Clearly they’ll move at a snail’s pace.

One thing giving the Fed the guts to hike, we think, is that mortgage rates are fairly stable, despite expectations of a December hike

Mortgage rates measured as a spread over like Treasury bonds, too, have stabilized–again, this seems to “give the Fed permission” to tighten