Stronger dollar by year end

Genevieve Signoret

Currencies

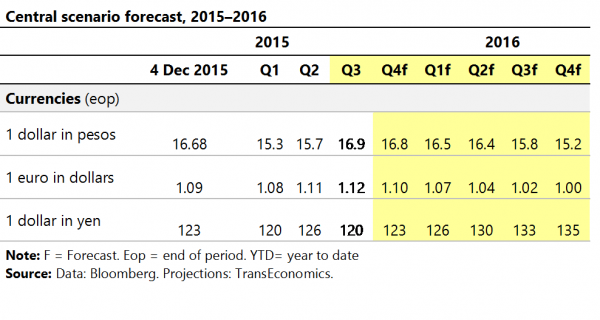

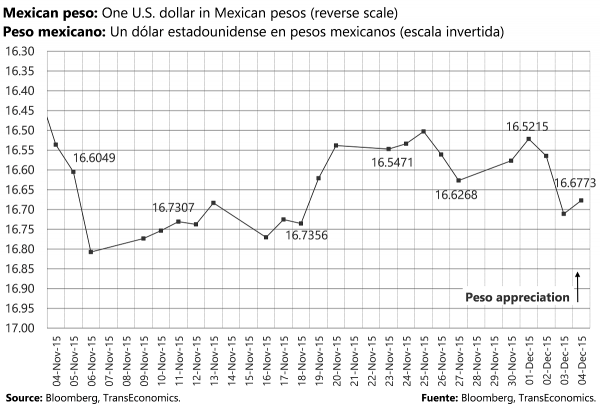

We provide updated forecast tables for forex. Note that we see dollar strengthening against the peso by year end to $1.00=MXN16.80. We’re advising clients with large peso holdings held at Mexican brokerage houses to hold them for now in mutual funds that hedge the dollar-peso in the short term.

Note further that we see the peso recovering over the course of 2016.

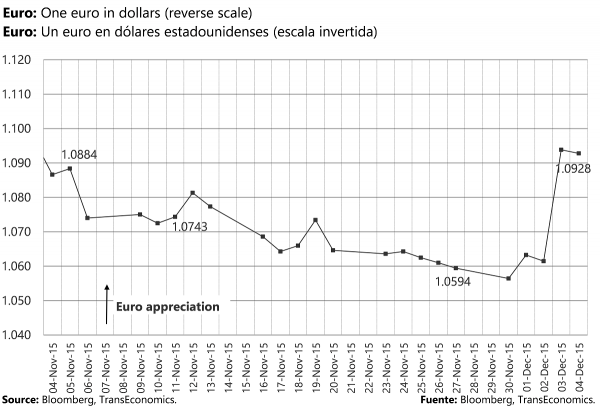

Scroll down to see how the euro spiked when European Central Bank President Mario Draghi under-delivered new stimulus yesterday relative to what the market was expecting. (Click here for the ECB communiqué and Q-A transcript in English and here for the communiqué in Spanish). That euro spike did not change our view on the euro-dollar. Rather, it brought the EUR/USD closer to our 1.10 forecast for the year-end rate.

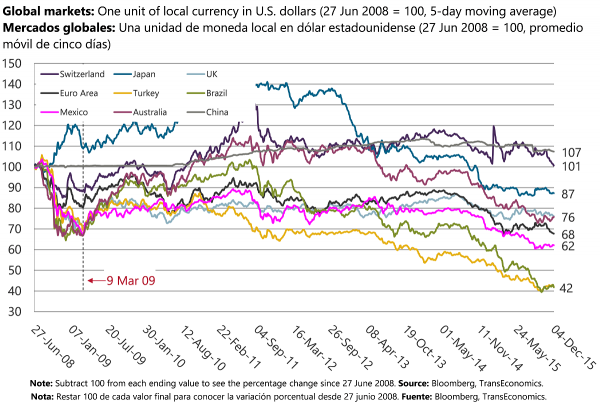

We see the yuan’s inclusion in Special Drawing Rights (SDRs) as an internal political coup for Chinese reformers that may improve China’s stature in the world but it has no short-term macro importance and hence no impact on our market views or portfolio strategies.

We provide updated forecast tables for forex

Yuan’s inclusion in SDR basket has no implications for our portfolio strategies

The euro spike brought the EUR/USD in line with our forecast for December 2015 of 1.10

We see the MXN weakening further against the USD this month to end 2015 around 16.80, then start a strengthening trend around April 2016

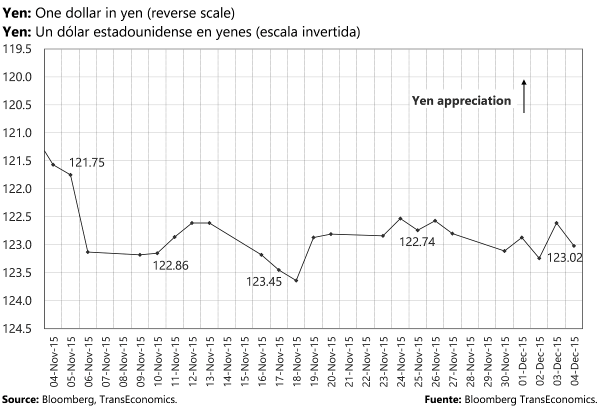

We see little yen movement for coming weeks but the weakening trend against the USD to continue for at least two years