Easy money

Genevieve Signoret

(Hay una versión traducida al español aquí.)

Monetary conditions are quite lax, and, although the fundamental driver of the bull market is economic recovery both ongoing and expected, easy money likely is adding fuel.

Money may in fact be too easy—inflation fears are on the rise, and bubbles may be forming (or even starting to pop).

Money is easy

Thanks to oceans of monetary and fiscal stimulus poured on globally since last March 2020 to help their citizens through the pandemic, especially in developed markets, short-term monetary policy rates are at or below zero; 10-year sovereign bond yields are -0.23% in Germany, 0.10% in Japan, and 1.63% in the United States; and the average 30-year U.S. mortgage rate has sunk from its already low 2019 year-end level of 3.74% to 2.97%.

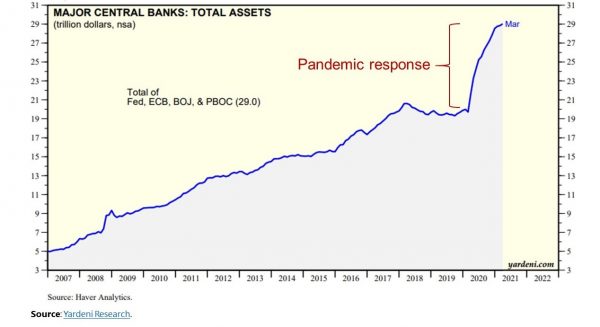

Central banks have poured money on the pandemic

We’re in a bull market

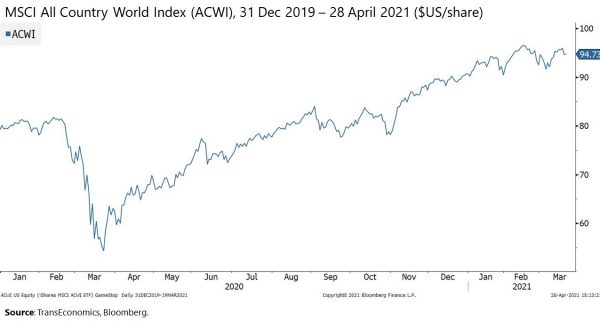

Two charts should persuade you that we’re in a bull market. The first is the MSCI All Country World Index (ACWI), a market-cap–weighted composite index of shares trading on 50 country stock markets:

Yes, it’s a bull market

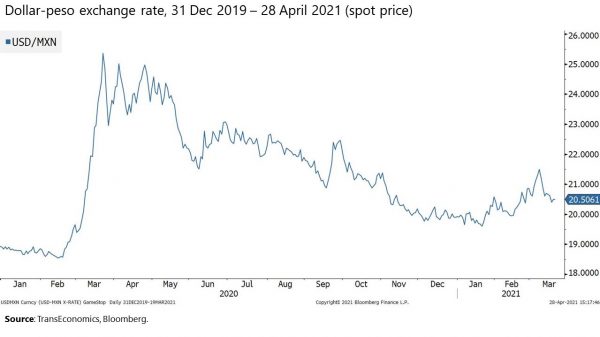

The second is the dollar-peso exchange rate. Risk appetites put upward pressure on emerging market assets and thus currencies such as the Mexican peso, and downward pressure on safe-haven currencies such as the U.S. dollar:

Strong risk appetites weaken the dollar against EM currencies such as the Mexican peso

Commodity prices are soaring

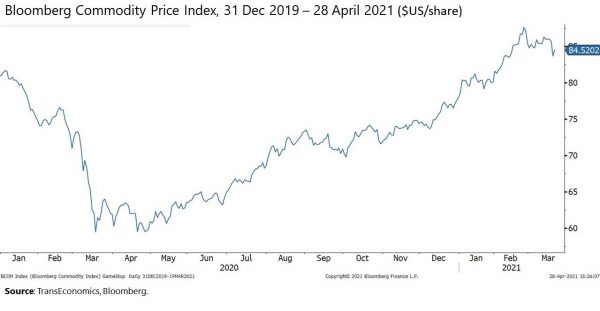

With the global economy recovering, commodity prices are soaring too:

Economic recovery is driving up commodity prices

Money may be too easy

Extremely easy money may lead to runaway inflation or spur the Fed to spring a hawkish surprise.

Runaway inflation would force central banks to aggressively hike rates.

A hawkish surprise would be an earlier-than-expected start of stimulus withdrawal by central banks to preempt runaway inflation.

In my view, both of these risks are tiny. But, in asset markets, I am a price taker; price drivers are the collective views of my fellow investors. And, each time inflation fears jump, so do yields, meaning that bond prices tumble. Also, because stock prices are probably being fueled in part by easy money, these can tumble then, too.

This makes my job as portfolio allocator tough. We money managers generally like to hedge against market panics by combining risk assets such as stocks with safe havens such as U.S. Treasuries, two asset classes that, more often than not, move in opposite directions. At inflection points such as today, however, the two can start to move together, making it harder than usual to keep a lid on portfolio volatility.

Note that fears of inflation also may be accelerating the surge in cryptocurrency valuations. Inflation fears often cause non–fiat-money such as gold and silver to appreciate against fiat money (the kind central banks issue). Cryptocurrencies may be turning into the new non-fiat–money of choice for hedging against inflation.

If so, and if today’s inflation fears later prove unfounded, cryptocurrencies will eventually correct downwards. Steeply.

Bubbles may be forming

Easy money can cause bubbles to form.

An asset price is said to be in a bubble when its price is spiraling far above a level justified by that asset’s fundamental value. Note that phrase: fundamental value. It is not a thing we can directly observe. Hence, while we can suspect that a bubble is forming, we cannot be certain that it actually did happen unless and until the bubble pops.

Easy money drives bubbles in (at least) two ways. First, it makes it cheap to leverage.

Second, it causes investors to stretch for yield.

Think of institutional investors such as pension fund managers needing to produce the yield needed to meet future obligations. They cannot rely on the cash flow from, say, buying 10-year U.S. Treasury bond that pays 1.65% and holding it to maturity. They look out on the risk frontier and see, say, corporate junk bonds, or emerging market bonds, and, with money so easy, the yields on those bonds fairly low, giving a false signal of safety.

I think you’re getting the picture: easy money makes actual risk hard to spot! When it does finally come to light, it tends to do so at the same time to everyone around the world at once: asset bubbles pop.

SPACs are sprouting

SPACs are publicly traded companies whose sole mission is to pick any private company it wants and acquire or merge with it, thus taking the company public, all for an outright fee of 5.5% and a hidden fee in the form of 20% of shares in the acquired company.

SPACs, also known as “blank checks”, are propagating quickly and raising capital easily. This surge in popularity is, I suspect, being driven by easy money.

Investors are ceding control to founders

More and more, unicorn founders are issuing special series of shares that give them managerial control disproportionate to their ownership shares. They are able to sell these shares like hot potatoes.

That investors want these non-voting shares in my view is yet one more symptom of … you guessed it …. easy money.

Don’t be giddy

Enjoy the bull run. And enjoy its fundamental driver, the economic recovery. But do so with eyes wide open to the risks posed by the added fuel of extremely easy money.