No Big Surprises in Developed-Market Long-Term Rates

Genevieve Signoret

(Hay una versión en español de este artículo aquí.)

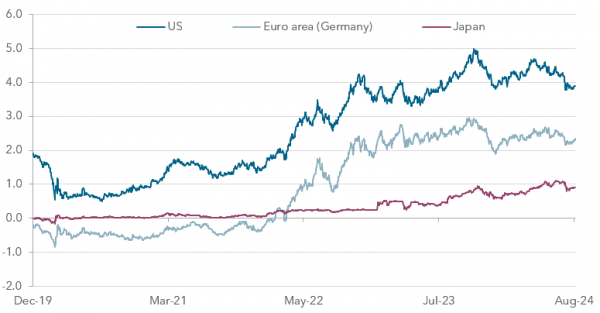

As we predicted last June, yields on the 10-year government bonds in the United States and Germany have come down. At the close of Friday 30 August, the yield on a 10-year U.S. Treasury note closed at 3.90%, down from the June 30 rate of 4.40%, and the Germany bund closed at 2.30%, down from its June 30 2.50%.

Long-term bond yields in Japan, by contrast, have trended up since last March 31 to 0.91% from 0.73%, in line with our expectations.

Developed-market long-term bond yields are moving roughly in line with what we anticipated last June, confirming our fixed-income strategies

Yield on a 10-year benchmark government bonds, %

Source: Bloomberg

Overall, global long-term rates are trending in the directions we expected last June, in support of our fixed-income investment strategies.

Genevieve Signoret teams up with TransEconomics to deliver serenity to high–net-worth families and individuals. To learn more, ask Genevieve for an appointment.