How are our model portfolios doing?

Genevieve Signoret

Our Performance

(Data corrected 21 May 2015)

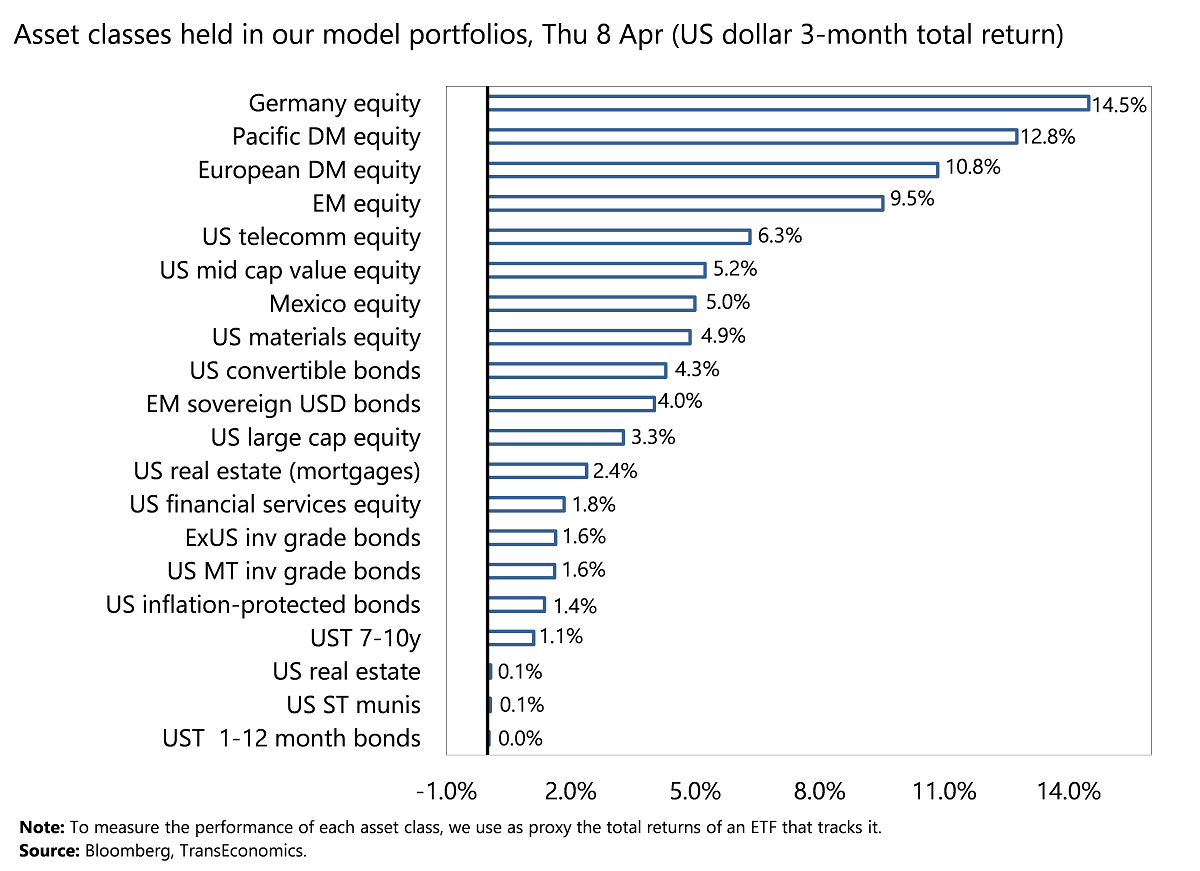

In the past three months, the asset classes in our model portfolios[1] that delivered the highest U.S. dollar returns were Germany equity (14.5%), Pacific developed market equity (12.8%) and European developed market equity (10.8%).

Producing the lowest returns (in dollar terms) were UST 1-12 month bonds (0.0%), US short-term munis (0.1%), and US real estate (0.1%).

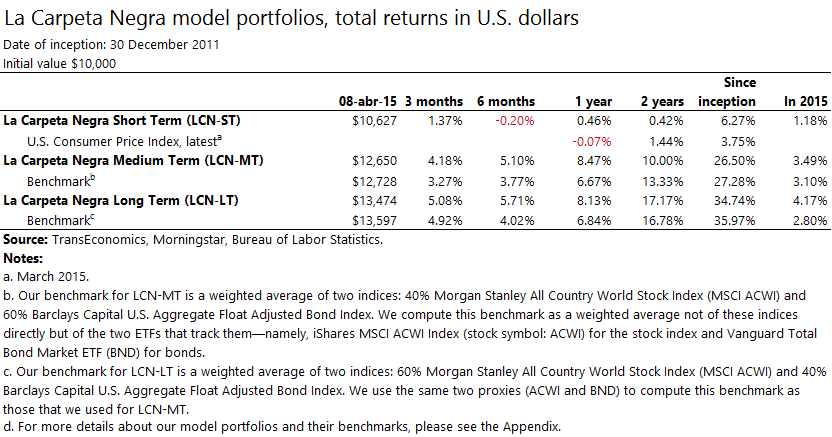

Over the past 12 months, all three of our model portfolios have outperformed their benchmarks:

- LCN-ST +0.5% (benchmark: 0.0%)

- LCN-MT +8.4% (benchmark: +6.7%)

- LCN-LT +8.1% (benchmark: +6.8%)

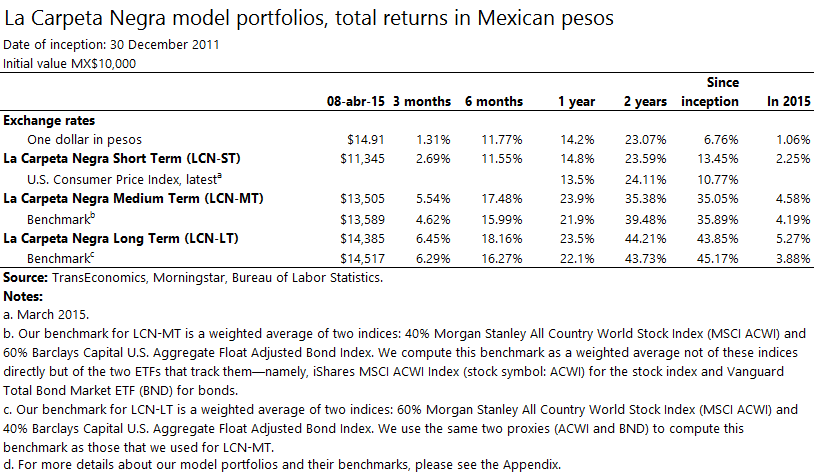

In peso terms, our 12-month performance was as follows:

- LCN-ST +14.7% (benchmark +14.2%)

- LCN-MT +23.9% (benchmark +21.9%)

- LCN-LT +23.5% (benchmark +22.1%)

[1] Read descriptions of these portfolios here. Clients receive details on their composition in addition to individualized strategies and portfolio management services. To request more information, please write to patrimonial@transeconomics.com.