We hold to our outlook for USTs

Genevieve Signoret

Fixed Income

Given uncertainty around Greece and the referendum it has scheduled for Sunday 5 July, we expect safe havens such as U.S. Treasury securities to move up in price a bit next week. Today the yield on the 10-year bond closed at 2.47%. But we are not revising down our forecast for the yield on that same bond at the close of Tuesday June 30 (when this quarter ends) from its current 2.45%. Tuesday is Jobs Report Day in the USA and we expect it to bring news on the U.S. labor market good enough to counteract the effect on bond yields of fears over Greece.

Yields on USTs maturing in less than 7 years now exceed their year-ago levels.

Yields on USTs maturing in less than 7 years now exceed their year-ago levels.

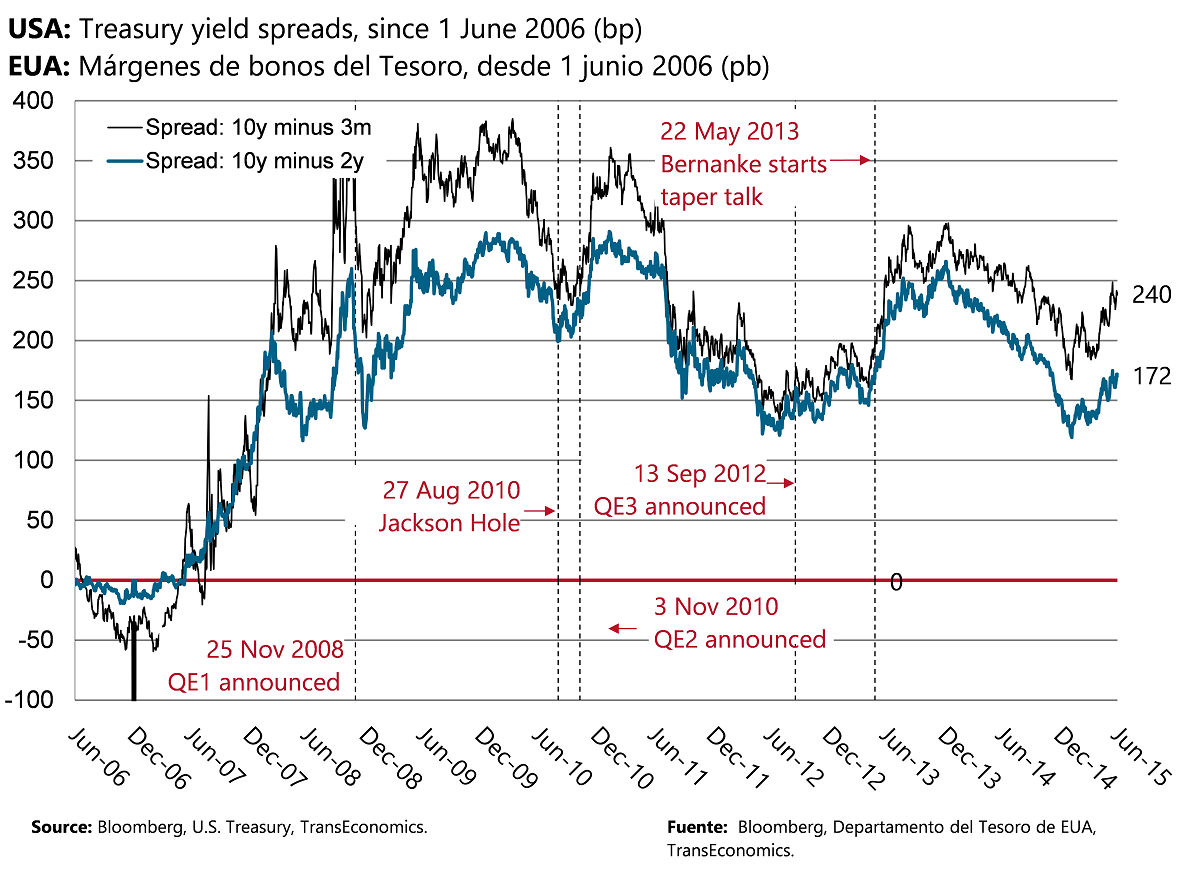

The U.S. yield curve is steepening. Once the Fed starts to hike, we expect it to flatten as the shortest-term yields move up faster than longer-term ones.

U.S. corporate bond risk spreads now exceed their long-term pre-crisis averages. We expect them to grow wider still.

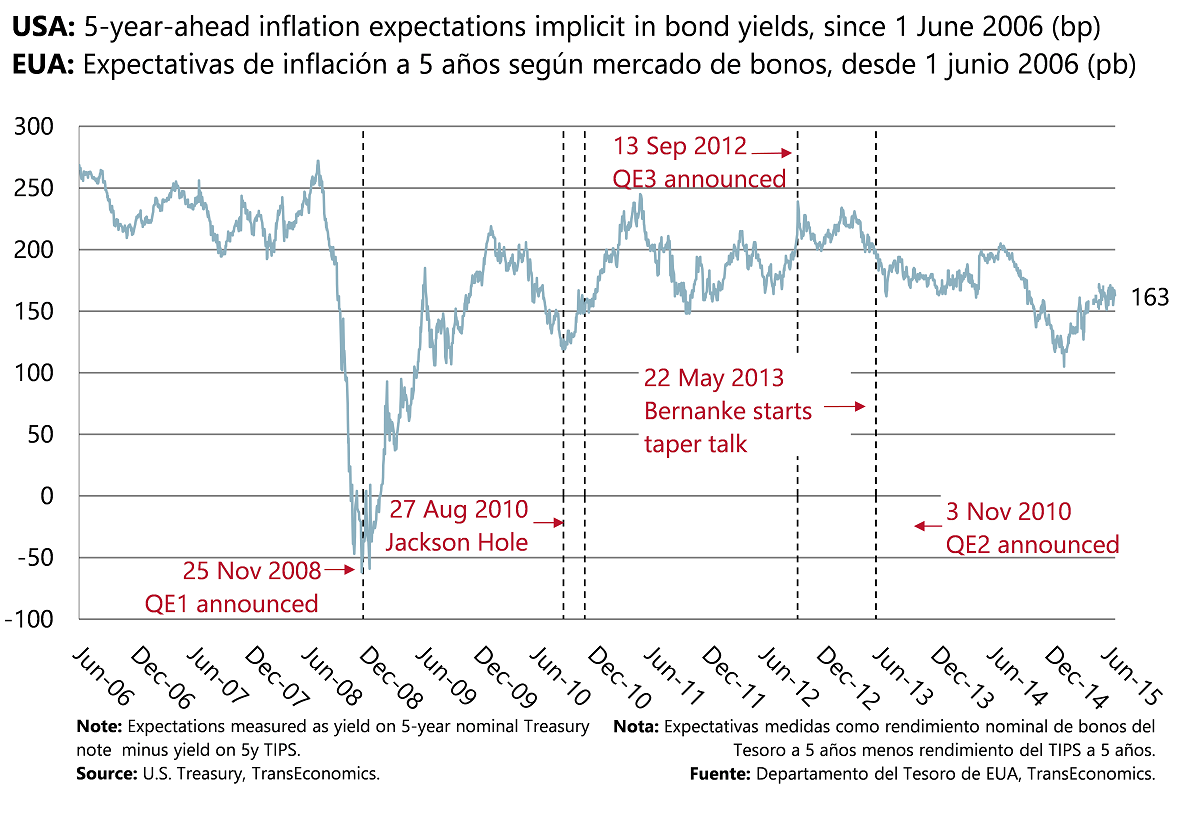

5-year TIPS are paying 0% again

We measure bond-price–implied inflation expectations for 5y ahead at a healthy 1.63%, which confirms our view: the Fed will hike in Sept.

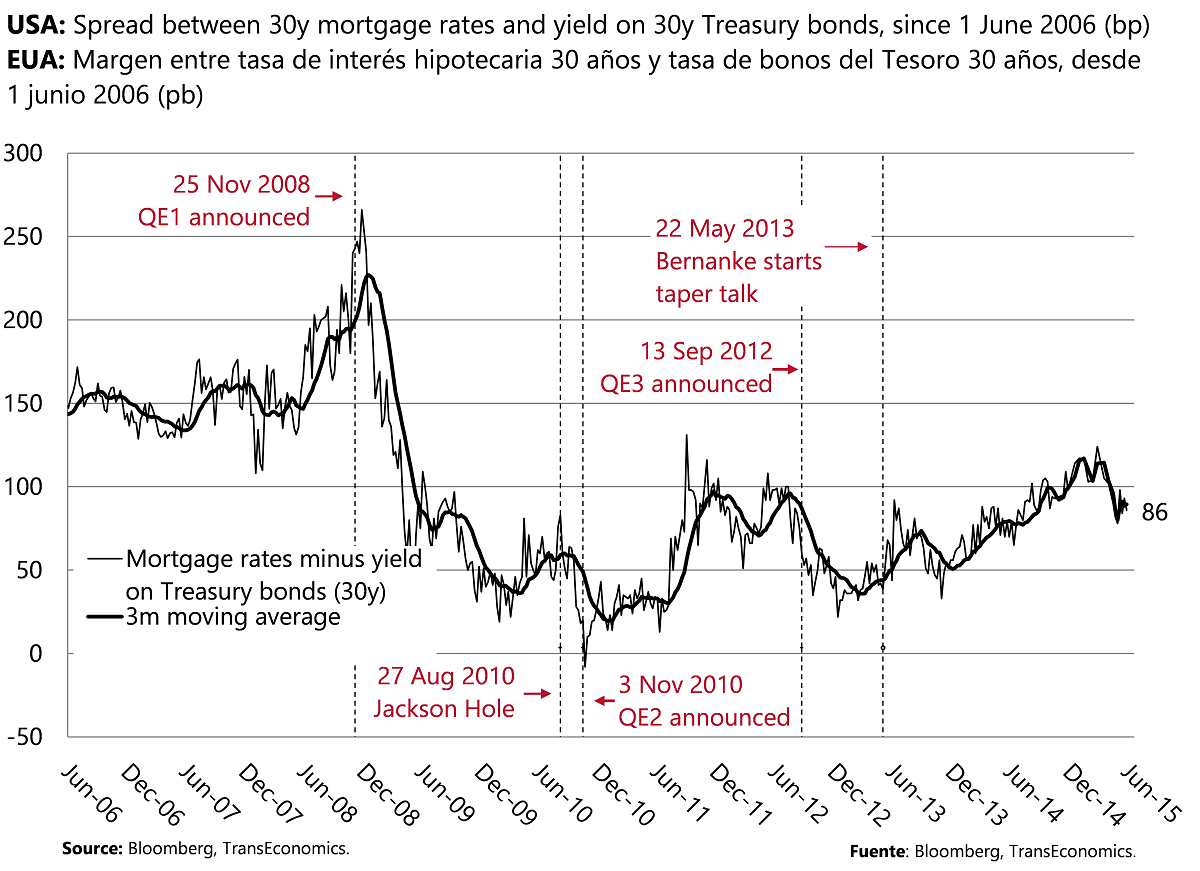

USA: 30y mortgage rates again top 4%. We expect them to keep creeping up over the next year, the pace of house price recovery to slow down.

The 30y mortgage rate spread over 30 USTs has begun widening. You can see why we favor U.S. bank equity in the forthcoming rate environment.