Again we revise our forex outlook

Genevieve Signoret

Currencies

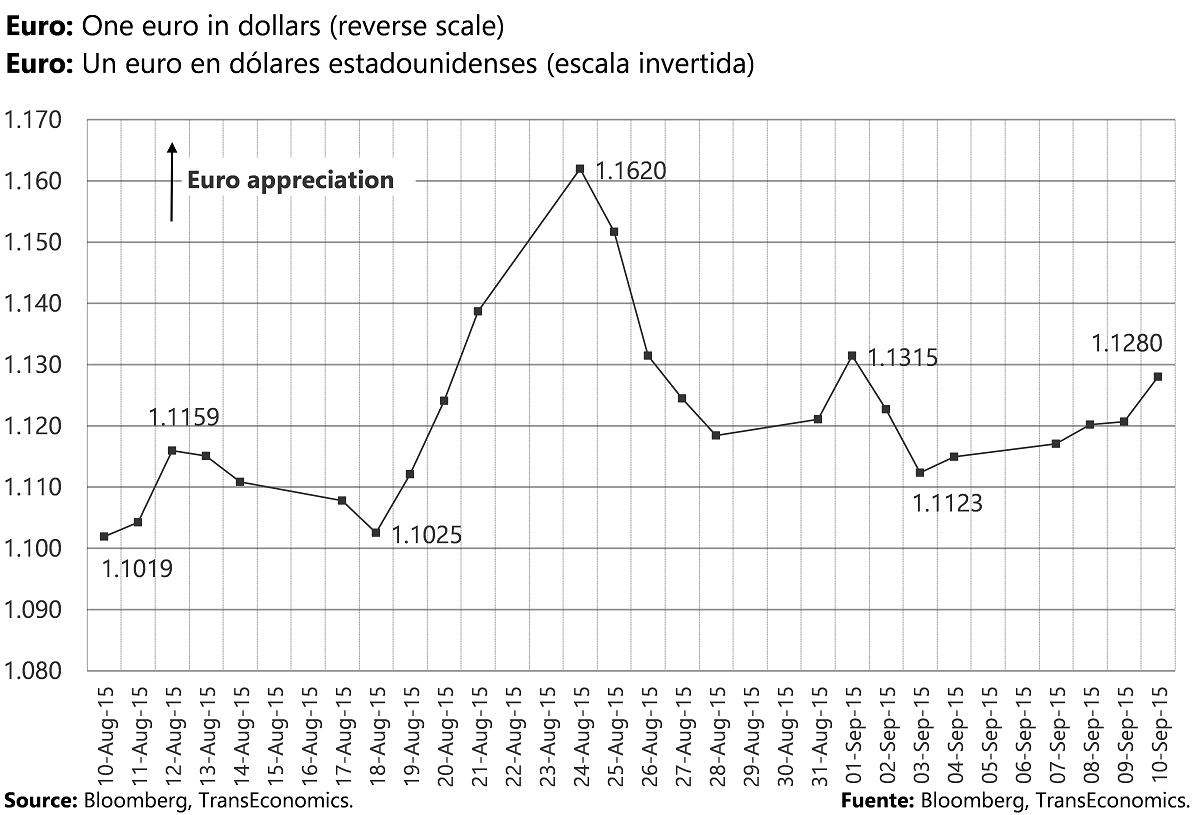

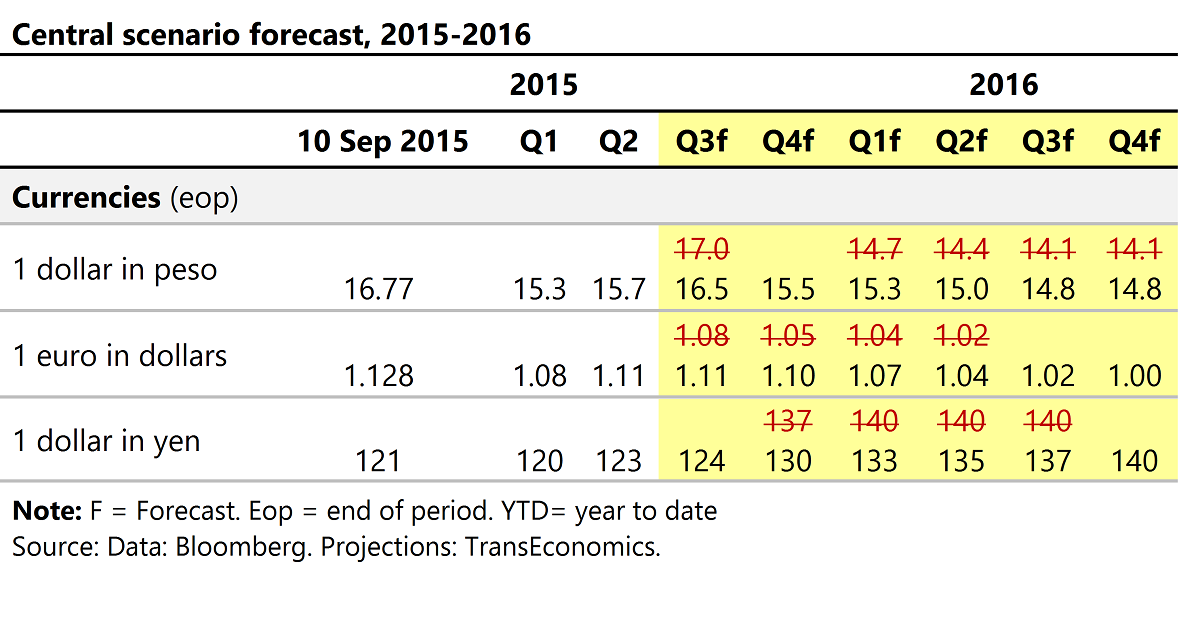

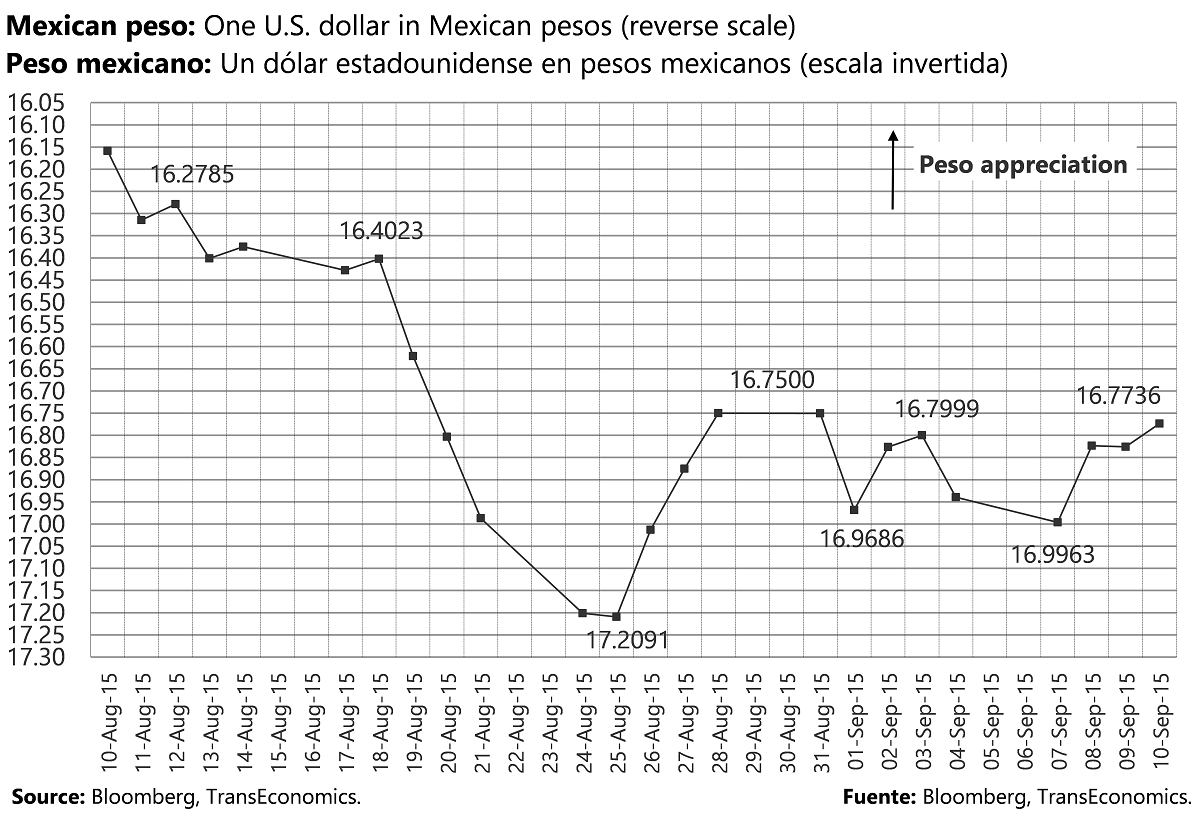

Once again we revise up our projections for the euro and yen against the dollar and down those for the peso.

Even though the European Central Bank is likely to loosen its monetary policy stance soon, the euro has a floor under it. This, we think, is because of the ongoing market panic. Our theory is that panic tends to drive up demand for safe-haven German bund and thus the euro.

In normal times, our yen story and the observed yen-dollar path would be similar to what we’re seeing today in the euro. But right now investors expect the Bank of Japan to add stimulus soon (speed up the pace of its asset purchase program). This expectation is offsetting the yen’s more typical tendency to gain against the USD in times of panic.

Again we revise our forex outlook

Data compendium

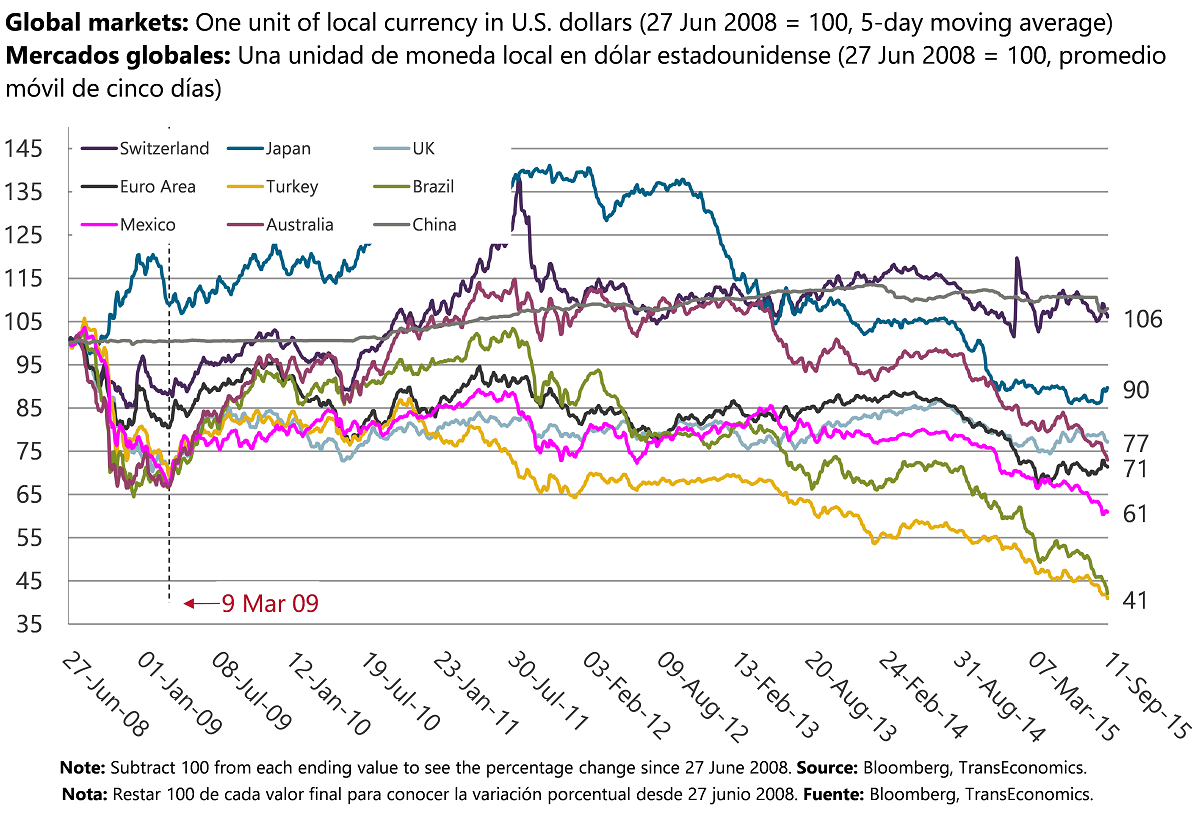

Non-U.S. currencies droop against the dollar

We now see USD/MXN at 16.50 by the end of 2015. We continue to project peso to strengthen in 2016 but less abruptly than we did before.

The euro is displaying safe-haven properties during the ongoing market panic. We think that thirst for the German Bund is supporting the euro.

Today’s market view that the BoJ will soon add stimulus is offsetting the yen’s more typical tendency to gain against the USD in times of panic.