USD-denominated fixed income shines

Genevieve Signoret

19 September 2015

Our Performance

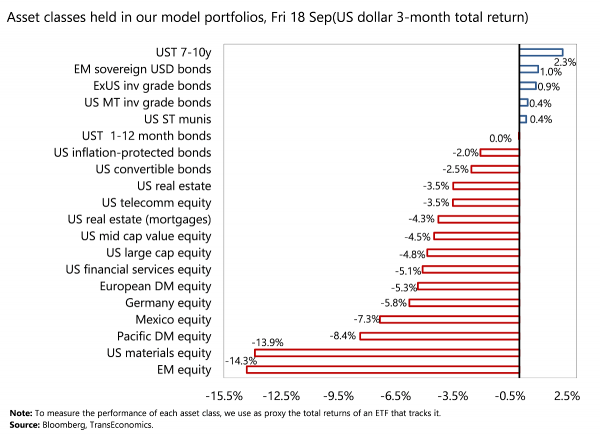

In the past three months, the asset classes in our model portfolios[1] that delivered the highest U.S. dollar total returns were 7–10-year U.S. Treasuries (+2.3%), emerging market USD-denominated sovereign bonds (+1.0%), and ex-U.S. investment grade bonds (+0.9%).

Producing the lowest returns (in dollar terms) were emerging market equity (‒14.3%), U.S. materials equity (‒13.9%), and Pacific developed market equity (‒8.4%).

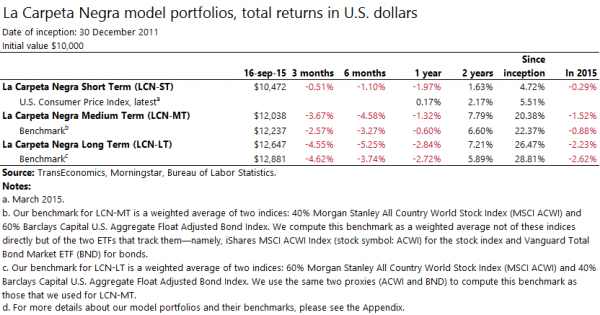

Over the past 12 months, none of our model portfolios have outperformed their benchmarks:

- LCN-ST ‒1.97% (benchmark +0.17%)

- LCN-MT ‒1.32% (benchmark ‒0.60%)

- LCN-LT ‒2.85% (benchmark ‒2.72%)

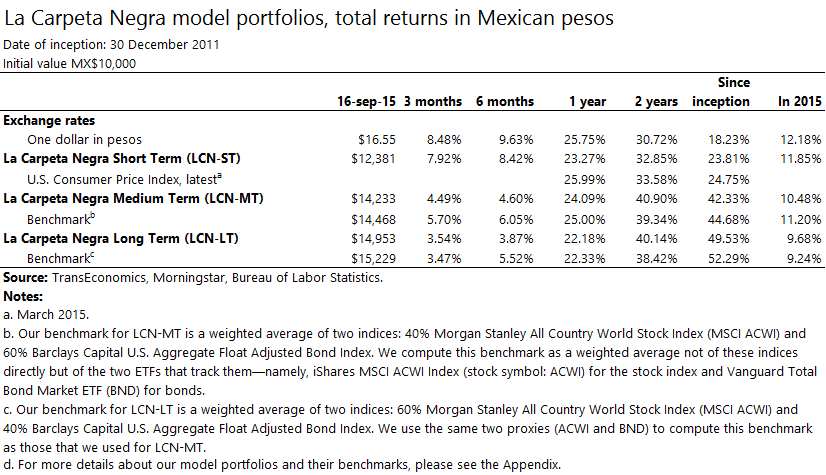

In peso terms, our 12-month performance was as follows:

- LCN-ST +23.75% (benchmark +25.99%)

- LCN-MT +24.09% (benchmark +25.00%)

- LCN-LT +22.18% (benchmark +22.33%)

Comentarios: Deje su comentario.