Investment grade developed market bonds outperform

Genevieve Signoret

02 October 2015

Our Performance

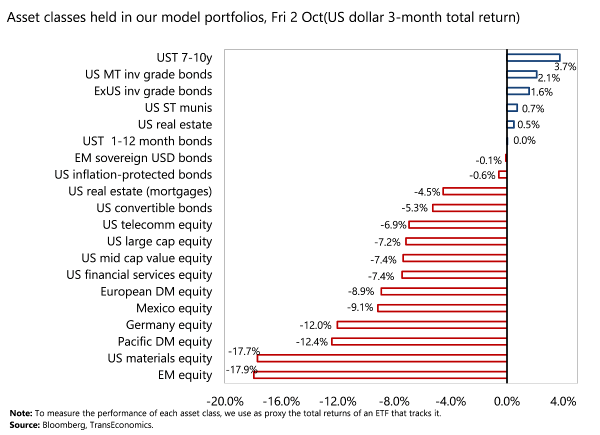

In the past three months, the asset classes in our model portfolios[1] that delivered the highest U.S. dollar total returns were 7–10-year U.S. Treasuries (+3.7%), US medium-term investment grade bonds (+2.1%) and ex-U.S. investment grade bonds (+1.6%).

Producing the lowest returns (in dollar terms) were emerging market equity (‒17.9%), U.S. materials equity (‒17.7%), and Pacific developed market equity (‒12.4%).

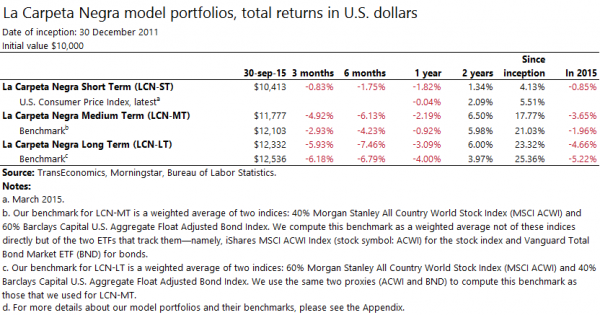

Over the past 12 months, one of our model portfolios have outperformed their benchmarks:

- LCN-ST ‒1.82% (benchmark ‒0.04%)

- LCN-MT ‒2.19% (benchmark ‒0.92%)

- LCN-LT ‒3.09% (benchmark ‒4.00%)

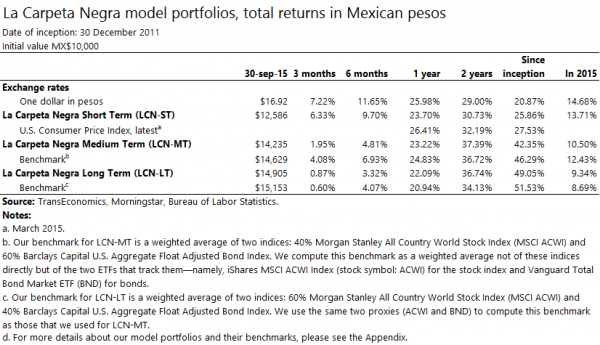

In peso terms, our 12-month performance was as follows:

- LCN-ST +23.70% (benchmark +26.41%)

- LCN-MT +23.22% (benchmark +24.83%)

- LCN-LT +22.09% (benchmark +20.94%)

Comentarios: Deje su comentario.