Do you have the right investment policy?

Genevieve Signoret

(Hay una versión en español de este artículo aquí.)

Before I say another word here at La Carpeta Negra, I need to ask: do you have the right investment policy?

Hint: if the bear market is causing you to lose even a wink of sleep, you probably do not.

No money you may need in the next two years should be subject today’s market volatility. And any funds you may need to dip into in the next six months should be in cash, by which we mean invested in your home currency in the money market, by which we mean AAA-rated debt instruments maturing in the next 12 months.

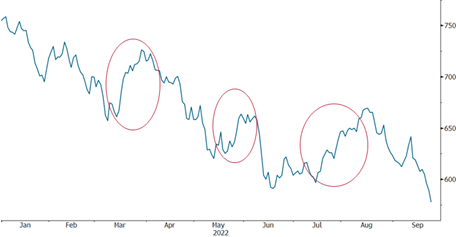

Three times during this year’s bear market, equity has rallied, only to resume its downward trend. These rallies are called “bear rallies”. Investors suffering from FOMO, or the Fear of Missing Out (of the market bottom), tend to get caught in them. They take cash they had been accumulating on the side lines and buy into the rally, only to find out later they had jumped the gun.

Investors, plagued with FOMO, are sometimes fooled by bear rallies

MSCI ACWI Index (a whole-world stock market index), year to 23 September 2022

Fuente: Bloomberg.

To illustrate the importance of your investment policy, I hereby confess that I personally got caught in the March and July bear rallies both. However, because I have the right investment policy, while it was unfortunate, it was by no means catastrophic. I hold scarcely any equity at all in brokerage accounts I may need to withdraw from over the next two years. And, over the next two years, the attractively priced shares I swooped up during those bear rallies are almost certain to produce strong returns.