How Are We Hedging Regional War Risk?

Genevieve Signoret

(Hay una versión en español de este artículo aquí.)

Since the October 7 Hamas terror attack on Israel that triggered a war in Gaza, we’re watching world oil prices like hawks but so far have made no changes to portfolio strategies.

In Regional War in the Middle East is Still a Tail Risk, published over at Timón Económico, my coauthor and I wrote that, whereas Dutch gas jumped on the start of the conflict and has remained high, Brent oil has barely budged. This is probably because world oil traders agree with us that, while the risk of a regional war in the Middle East is higher than it was a month ago, it remains quite small. Note that, by “regional war”, we mean one involving direct military Israeli or U.S. engagement with Iran.

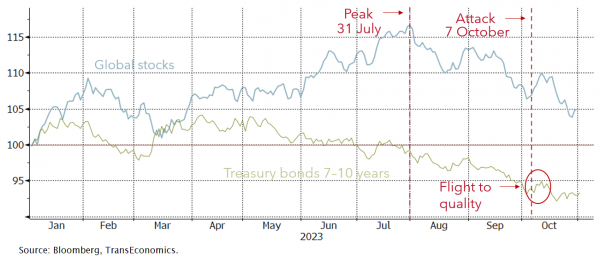

In the chart below, you can see a downturn in world stocks happening now. Given that it began early last August, we do not attribute it to the war in Gaza. We attribute it to persistently rising yields on long-term Treasury securities:

We think that driving the sell-off in stocks is the persistent rise in long-term US Treasuries (LT USTs). Note how a burst of fear that Iran will become directly drawn into the war in Gaza sparked a brief episode of flight to quality (a small spike in LT UST prices).

Global stocks and long-term US Treasury securities (Daily closing prices for MSCI ACWI Index ETF and iShares 7–10 Year Treasury Bond ETF, 100= 31 December 2019)

We suspect that long-term U.S. Treasury yields are close to or at their peak. If true, long-term Treasuries are a buy. We hold them systematically, currently in the 7–10-year duration range.

For investment horizons of five years and up, our hedge against a spike in fear over the war in Gaza is precisely long-term U.S. Treasuries. You can see in the chart above how, for a few days, they did spike on war fears, in a flight to quality.

For medium-term (2–5-year) investment horizons, our hedge is an ETF of managed futures for which the underlying assets hail from a variety of classes: commodities, currencies, equities, and rates. Its fund managers take long or short positions in these asset classes in hopes of capturing price movements in either direction.

Our shorter-term portfolios are allocated mostly to Cetes or T-Bills.