Mexico and EM equity and US real estate lead the pack

Genevieve Signoret

22 August 2014

Our Performance

In the past three months, the asset classes in our model portfolios[1] that delivered the highest U.S. dollar returns were Mexico equity (+7.3%), emerging market equity (+6.4%), and US real estate (+6.3%).

Producing the lowest returns (in dollar terms) were Germany equity (–6.1%), broad commodities (–5.5%), and European developed market equity (–3.2%).

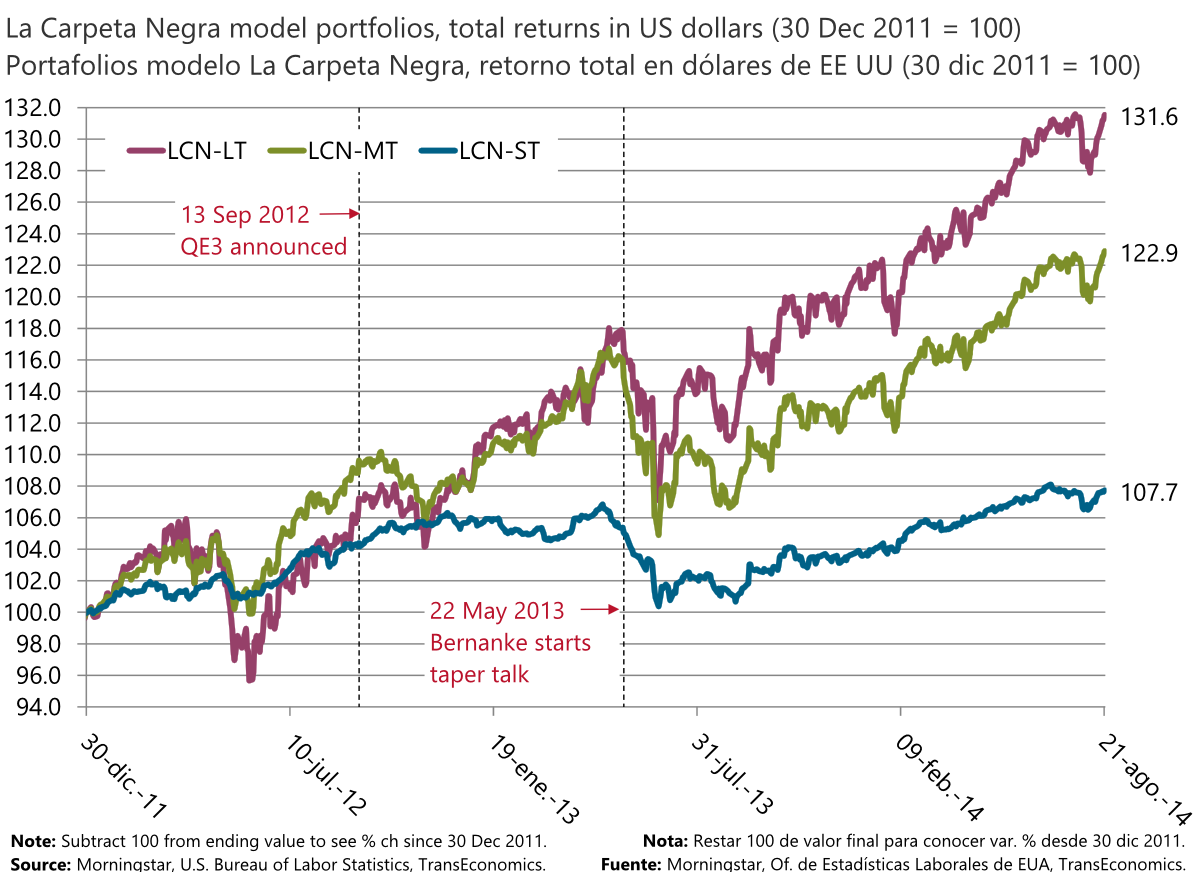

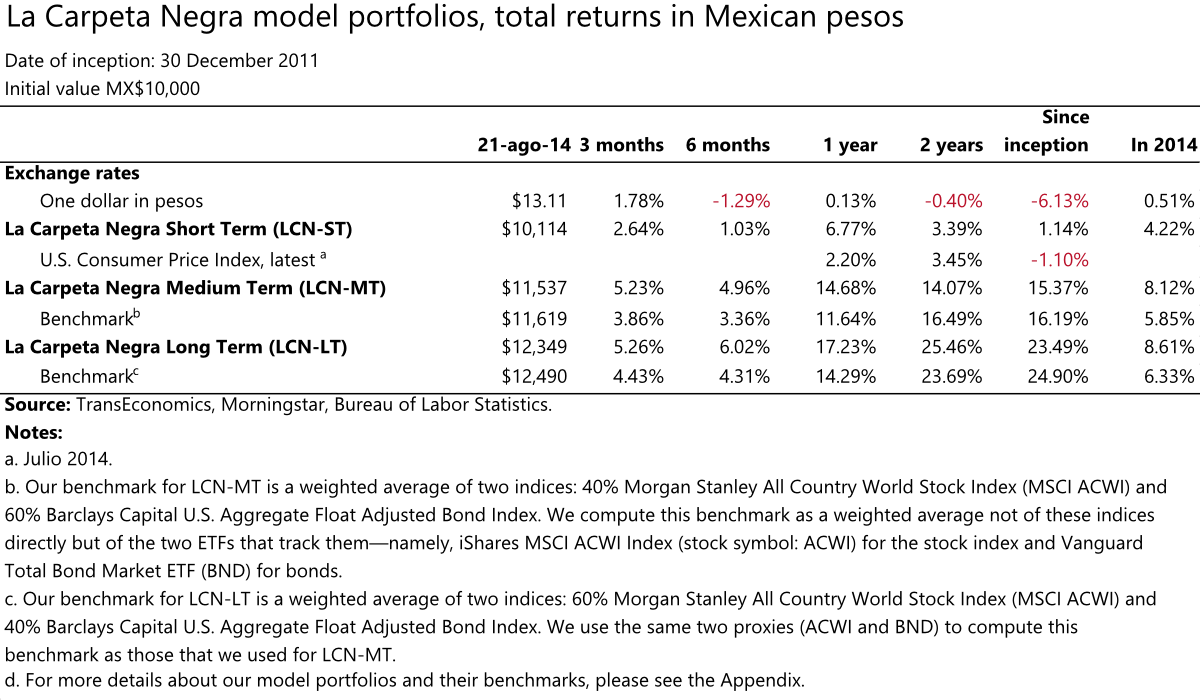

Over the past 12 months, all our model portfolios have outperformed their benchmarks:

- LCN-ST +6.6% (benchmark: +2.1%)

- LCN-MT +14.5% (benchmark: +11.5%)

- LCN-LT +17.1% (benchmark: +14.1%)

[1] Read descriptions of these portfolios here. Clients receive details on their composition in addition to individualized strategies and portfolio management services. To request more information, please write to patrimonial@transeconomics.com.

Comentarios: Deje su comentario.